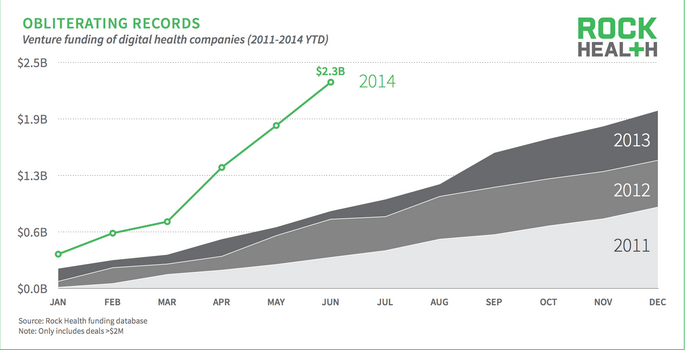

In just the first 6 months of 2014, 143 Digital Health (DH) companies have raised $2.3B! This has been driven by a greater number of companies raising funds and a growing average deal size – $15.6M vs $10M

This explosive growth in DH funding represents 168% YoY growth. To give this number context, the delta in venture funding 2014 Q1 vs 2013 Q1:

- DH: 85%

- Biotech: 22%

- Med Device: 5%

To address talk of a bubble, we should keep in mind that $2.3B is a fraction of the funds being raised in other healthcare verticals. Other analysts have also observed that we are still nowhere near the frothy 1999-2000 numbers.

Most of this new funding is being allocated to 6 key sub-sectors (2014YTD funding):

- Payer administration ($211M)

- Digital medical devices ($206M)

- Analytics & big data ($196M)

- Healthcare consumer engagement ($193M)

- Population health management ($162M)

- Personalised medicine ($150M)

It should be noted that success rates on crowd funding platforms such as Indiegogo are almost down 50% YoY which may be related to some of the “scampaign” headlines over the past few months.

To reflect the continued growth of the DH sector, Rock Health, the author of this report, has created a Digital Health Public Company Index.

A growing number of technology and strategic investors are becoming the most active in DH including Qualcomm, Google Ventures, Matrix Partners and other well known venture funds.

Medical device companies have increased their appetite for digital health companies as they evolve their business models e.g. Medtronic acquiring Corventis. We have also seen a number of high profile IPOs in 2014 e.g. castlight in March. This momentum is building investor expectations of exits given the amount to funding to date.

For further information, please refer to the Rock Health website

#propellgroup #digitalhealth